Introduction to Sustainable Investing 101

In a world facing pressing environmental and social challenges, sustainable investing has emerged as a powerful approach for investors who want to make a positive impact while seeking financial returns. Sustainable investing, also known as socially responsible investing (SRI), is an investment strategy that considers environmental, social, and governance (ESG) factors alongside financial performance.

This article serves as a beginner’s guide to understanding sustainable investing and its potential for creating a more sustainable future.

Sustainable investing goes beyond traditional financial metrics and takes into account the triple bottom line: people, planet, and profits. It seeks to align investment decisions with personal values and support companies that prioritize sustainable practices, social responsibility, and ethical business conduct.

By investing in such companies, individuals can contribute to positive change in areas like climate change mitigation, social equality, and responsible corporate governance.

Environmental Considerations

One crucial aspect of sustainable investing is the evaluation of environmental factors. Investors analyze how companies manage their impacts on the environment, such as their carbon emissions, waste management practices, and resource conservation efforts.

By investing in businesses with strong environmental stewardship, individuals can support the transition to a low-carbon economy and sustainable use of natural resources.

Social Factors

Sustainable investing also emphasizes social considerations. Investors assess how companies address social issues like labor practices, human rights, diversity and inclusion, community engagement, and product safety. By investing in socially responsible companies, individuals can contribute to positive social change and support businesses that prioritize fair labor practices, social justice, and community well-being.

Governance and Ethical Practices

The governance aspect of sustainable investing focuses on evaluating a company’s leadership, board structure, transparency, and ethical business practices.

Investors consider factors such as executive compensation, shareholder rights, and anti-corruption policies.

By investing in companies with robust governance practices, individuals can encourage accountability, integrity, and responsible decision-making within corporations.

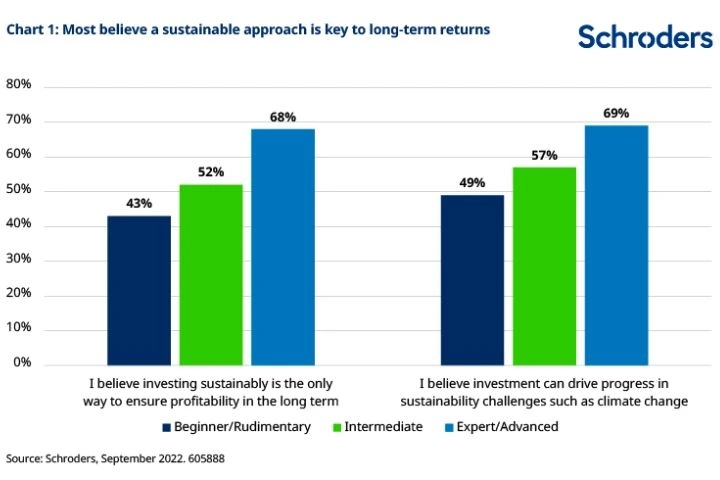

68% of investors believe sustainable investing is likely to drive long-term returns

schroders.com

Different Approaches to Sustainable Investing

Sustainable investing offers various approaches to suit different investor preferences. One approach is exclusionary screening, where investors exclude specific industries or companies based on certain criteria, such as fossil fuels, tobacco, or weapons.

Another approach is inclusionary screening, which actively selects companies that demonstrate strong ESG performance or align with specific sustainability themes, such as clean energy or water conservation.

Impact Investing

Impact investing takes sustainable investing a step further by intentionally seeking investments that generate measurable social and environmental impact alongside financial returns. Impact investors prioritize projects and companies that tackle specific issues, such as affordable housing, renewable energy, or access to education. Impact investing offers the potential for both financial gain and direct positive change in targeted areas.

Measuring Performance and Returns

Evaluating the performance of sustainable investments requires a combination of financial analysis and ESG metrics.

Several rating agencies and research firms assess companies’ ESG performance, providing investors with data and ratings to inform their investment decisions. It’s important to note that sustainable investing does not necessarily mean sacrificing financial returns. In fact, studies have shown that companies with strong ESG practices often outperform their peers over the long term.

Getting Started with Sustainable Investing

To embark on a sustainable investing journey, beginners can follow a few steps. First, clarify personal values and determine the sustainability issues that resonate most strongly. Next, research and identify sustainable investment options that align with those values.

Consider consulting with a financial advisor who specializes in sustainable investing to gain insights and guidance. Finally, start with smaller investments and gradually increase involvement as confidence and understanding grow.